This article aims to provide insight into the differences between hot and cold wallets, and how to set them up. If you are unfamiliar with decentralized finance (DeFi) wallets, consider reading our articles on cryptocurrency, DeFi, and how to buy crypto before reading this article.

Everyone needs a wallet, even in the world of crypto. Crypto wallets come in the form of both platforms and physical devices aimed at keeping users’ crypto safe and accessible. In essence, users do not hold their crypto in a physical wallet. Instead, coins and tokens reside on blockchains, and the wallet grants access to these digital assets through a pair of encrypted codes known as public and private keys that are central to the utility and security of a wallet. The public key is used to send crypto to and from wallets, while the private key validates transactions and verifies ownership of a blockchain address.

The two types of crypto wallets are hot wallets and cold wallets, each with its own advantages and disadvantages.

Hot Wallets vs. Cold Wallets

Security

Security is a critical issue in crypto, and especially so in DeFi. However, when it comes to infrastructural tools in the crypto space, there is typically a trade-off between usability and security – crypto wallets are no exception. While hot wallets are quick and easy to use, often just needing a click or a password to access, they are connected to the internet via a computer or phone. This means they are not entirely safe from hacks and other malicious acts, such as dusting attacks that aim to penetrate the privacy of a blockchain network and dox users. In addition, decentralized applications (dApps) operate on the blockchain without a central entity to provide customer support if users’ assets are misplaced or stolen. Thus, there is considerable risk when using a hot wallet.

On the other hand, cold wallets are the better option where safety is concerned, having a reputation of being “impenetrable”. After all, users’ addresses and private keys are being held offline, a safe arm’s length away from the internet and potential malware. When a significant amount of funds is involved, investing in a cold wallet is recommended to boost users’ defense against the many bad actors in the crypto landscape.

Accessibility

Since most crypto activity occurs on the internet, hot wallets are a significant part of the DeFi ecosystem and are more popular than their “colder” counterpart. Transactions are easy, accessible, and often free to use. On the other hand, hardware wallets have a price tag, and using them is tedious. While users can view their crypto holdings in the wallet since ownership is stored on the blockchain, keys are placed in cold storage, and they cannot use their crypto until these keys are moved back into a hot wallet for use in a transaction. There is also the added responsibility of keeping it somewhere safe without losing or misplacing it.

After choosing a type of wallet, users are faced with setting up the storage model. Unlike a regular wallet with fiat, crypto assets are digitized, and the process is not as simple as physically filling the wallet with coins. Instead, each type of wallet has different installation procedures, and this article aims to break the process down through a step-by-step guide!

Hot Wallets

Hosted Wallets

There are two kinds of hot wallets: hosted and online wallets. Hosted wallets are the easiest to set up, given that most centralized exchanges such as Binance and Coinbase offer users a default digital wallet to store their crypto. Compared to a custodial wallet, users trust exchanges to act as a third party that keeps their assets for them, similar to savings accounts offered by traditional financial (TradFi) institutions. With a hosted wallet, users do not have to worry about losing their password or private keys. However, using centralized finance (CeFi) platforms often limits users’ investment options in the crypto space.

Steps to Set Up a Hosted Wallet:

1. Choose an Exchange

Security and fees are two important factors to consider when choosing a crypto exchange. Finding a trusted crypto exchange can be done by researching whether it has a track record of security attacks or offering fraudulent crypto tokens. Moreover, each exchange has varying fees one must undertake to purchase and store their crypto coins. For example, Crypto.com offers lower credit card purchase fees than Coinbase. However, Coinbase’s wallet is more user-friendly, which is especially helpful for beginners. Other factors to include tradable coins on the exchange or the currencies accepted.

2. Create an Account

Most exchanges mandate that users set up two-step verification (2FA) for their accounts for greater security.

3. Buy or Transfer Crypto

Since most crypto platforms allow users to buy crypto using their bank accounts or credit cards, users can transfer their pre-existing crypto assets into their new hosted wallet for storage. Learn more about the steps to buying crypto here!

Online Wallets

Online wallets, on the other hand, are self-custodial. This means that no financial intermediaries are involved in the safekeeping of your digital assets. Self-custodial wallets grant users complete control over their crypto and access to more advanced crypto activities such as staking and lending. However, the responsibility of remembering and protecting private keys from hackers falls entirely on the user.

Steps to Set up an Online Wallet:

1. Download Web/Mobile Application

Online wallets usually come in the form of browser extensions or mobile applications. For example, MetaMask can be installed as a chrome extension on computers, while wallets like Trust Wallet are only available on mobile devices. Some wallets, such as the Coinbase Wallet, are available on both mediums

2. Set up an Account

Similar to hosted wallets, 2FA verification will be set up alongside creating your “private keys” or “seed phrase”. Seed phrase refers to a unique recovery phrase that users must enter to access their crypto wallet. While private keys uniquely link users to their wallet address, granting them access to their assets on the blockchain, the seed phrase serves the function of a “master key” to one’s wallet. Rather than providing access to a single blockchain address, it enables users to recover access to all private keys stored in the wallet.

3. Transfer Crypto to Your Wallet

Unlike hosted exchanges, most online wallets may not allow purchases using traditional currencies, such as USD or Euro. Some wallets can also hold a specific type of token or coin, which limits the liquidity pools users can interact with. For example, a wallet that only supports ERC-20 tokens does not permit users to interact with USD-ETH automated market makers (AMMs). Users should thus research the type of currencies and crypto assets a wallet supports before committing their funds.

Cold Wallets

Hardware

Hardware wallets are physical devices that store your private keys offline. These devices are usually the size of a thumb drive and act similarly to one. With your crypto assets kept offline, hardware wallets protect against malicious actors, such as hackers conducting phishing and malware attacks. However, the price of hardware wallets may deter investors from adopting them, as these devices can cost up to US$100.

Steps to Set up a Hardware Wallet:

1. Purchase the Hardware Wallet

Popular brands of hardware wallets include Ledger and Trezor, and most devices can only be purchased online.

2. Install the Relevant Software

After plugging in the device, visit the developer’s website. For example, in the case of Trezor, the website will initialize the wallet and install the security software. The system will then create your keys and store them in the hardware for safekeeping. Moreover, a recovery key consists of a unique string of digits. The exact number of digits varies with the type of hardware wallet. The best way to keep your pin and keys safe is through paper wallets, which refers to users writing down their passwords onto pieces of paper and storing them in a few different places.

3. Transfer Crypto to Your Wallet

Like an online wallet, a hardware wallet typically does not support fiat currencies. To purchase crypto, you will need to purchase them on an exchange before transferring them into the hardware wallet.

DeFi Wallets: An Essential Tool

Ultimately, hot and cold wallets are pertinent to crypto activity, and despite their differences, they have a place in everyone’s arsenal. While ease of use is key to a seamless user experience and is essential considering the fast-paced nature and volatility of crypto markets, security in the space can never be taken for granted. This is especially so in DeFi, since tokens, once lost, can never be retrieved.

Setting up your own crypto wallet is necessary to jumpstart your crypto journey. The kind of wallet chosen will vary depending on your risk appetite and budget. You may even opt for a combination of hot and cold wallets to ensure greater security for your crypto assets. The freedom of the crypto ecosystem even extends to the method of storing your digital assets.

Disclaimer

This publication is provided for informational and entertainment purposes only. Nothing contained in this publication constitutes financial advice, trading advice, or any other advice, nor does it constitute an offer to buy or sell securities or any other assets or participate in any particular trading strategy. This publication does not take into account your personal investment objectives, financial situation, or needs. Treehouse does not warrant that the information provided in this publication is up-to-date or accurate.

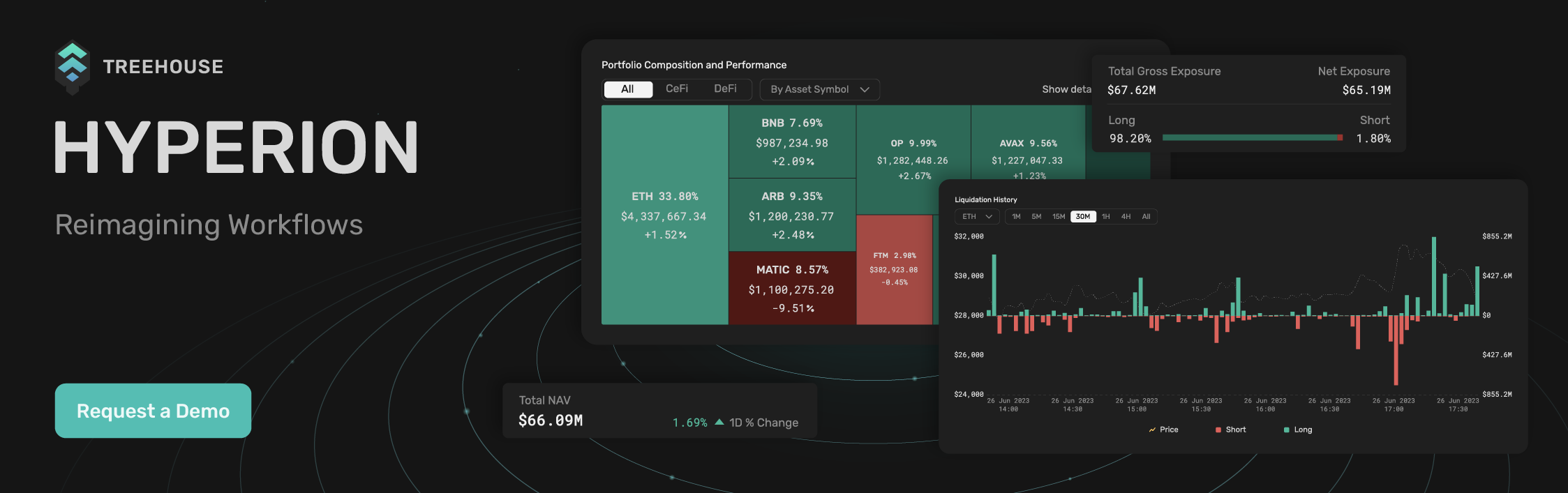

Hyperion by Treehouse reimagines workflows for digital asset traders and investors looking for actionable market and portfolio data. Contact us if you are interested! Otherwise, check out Treehouse Academy, Insights, and Treehouse Daily for in-depth research.