This article aims to introduce the primary forms of investment risk present in Decentralized Finance (DeFi) and elaborates on these risks through three basic investment strategies that show the relative extent of risk exposure. If you are unfamiliar with DeFi, do read our introductory articles on DeFi, cryptocurrency, how to do your own research (DYOR), and DeFi risks before reading this article.

What Is Price Risk?

Price risk refers to the probability of a decrease in the monetary value of an asset. It is the most fundamental form of risk that every investor is exposed to, regardless of the asset in question, and it must be considered when investing or trading in the space. Cryptocurrencies are no exception, and are especially susceptible to price risk due to the volatile, unpredictable nature of the space.

When holding multiple cryptocurrencies, a portfolio’s exposure to price risk is influenced by the price fluctuations of its underlying assets. For example, if a user has 1 Ether (ETH) in their portfolio, and the value of ETH falls by $1, the user bears an unrealized loss of $1. However, the relationship between the type and amount of assets in a portfolio and the magnitude of price risk is hardly ever linear. In modern finance, many strategies have been developed to use this complex relationship to optimize returns. A few of these strategies will be discussed below.

Manage your risks with this framework!

Types of Price Risk

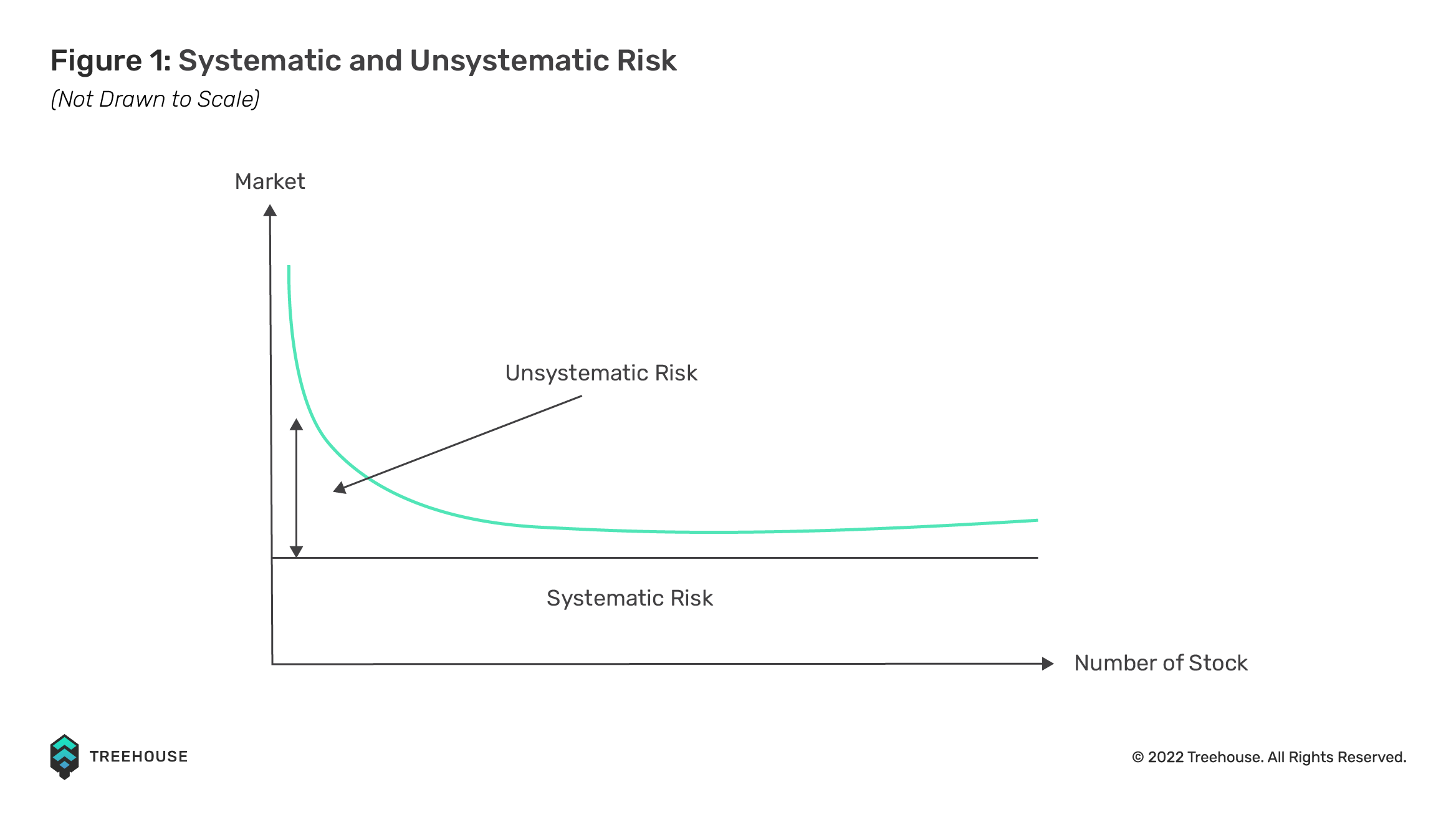

There are two broad categories of price risk – market risk and unsystematic risk. To adopt the relevant investment strategies, it is important to understand what these risks entail.

Market Price Risk

Market price risk, also known as systematic risk, is associated with the market as an aggregate. This risk affects every asset and is non-diversifiable. For instance, a negative outlook on the global economy or a ban on crypto trading imposed by a governing authority might cause the entire crypto market to tank.

Unsystematic Price Risk

Conversely, unsystematic price risk refers to the inherent risk associated with a specific asset or group of assets. For example, speculations of a rug pull or faults in the technology and software of a crypto project might expose the project to the possibility of a downturn.

Unlike market price risk, unsystematic price risk can be diminished through portfolio diversification by not “putting all your eggs in one basket”. Going all-in on a single token will expose an investor to unnecessarily high unsystematic risk, which can be easily avoided by holding multiple cryptocurrencies.

Price risk may seem straightforward and obvious at first glance. However, price risk dynamics are not always constant or linear, and this will surface when we discuss leverage and short positions.

Risk is ever-present in markets, and where there is potential for profit, there will be risk. Hence, it is important to understand investment or trading strategies, as they play a crucial role in determining the price risk investors are exposed to.

Learn more about risk premia in our Insights piece “Deconstructing DeFi Returns: Harvesting Risk Premia“!

Basic Trading Strategies

This article discusses risk with respect to the three basic strategies for trading or investing in crypto or any other forms of assets.

1. Going Long

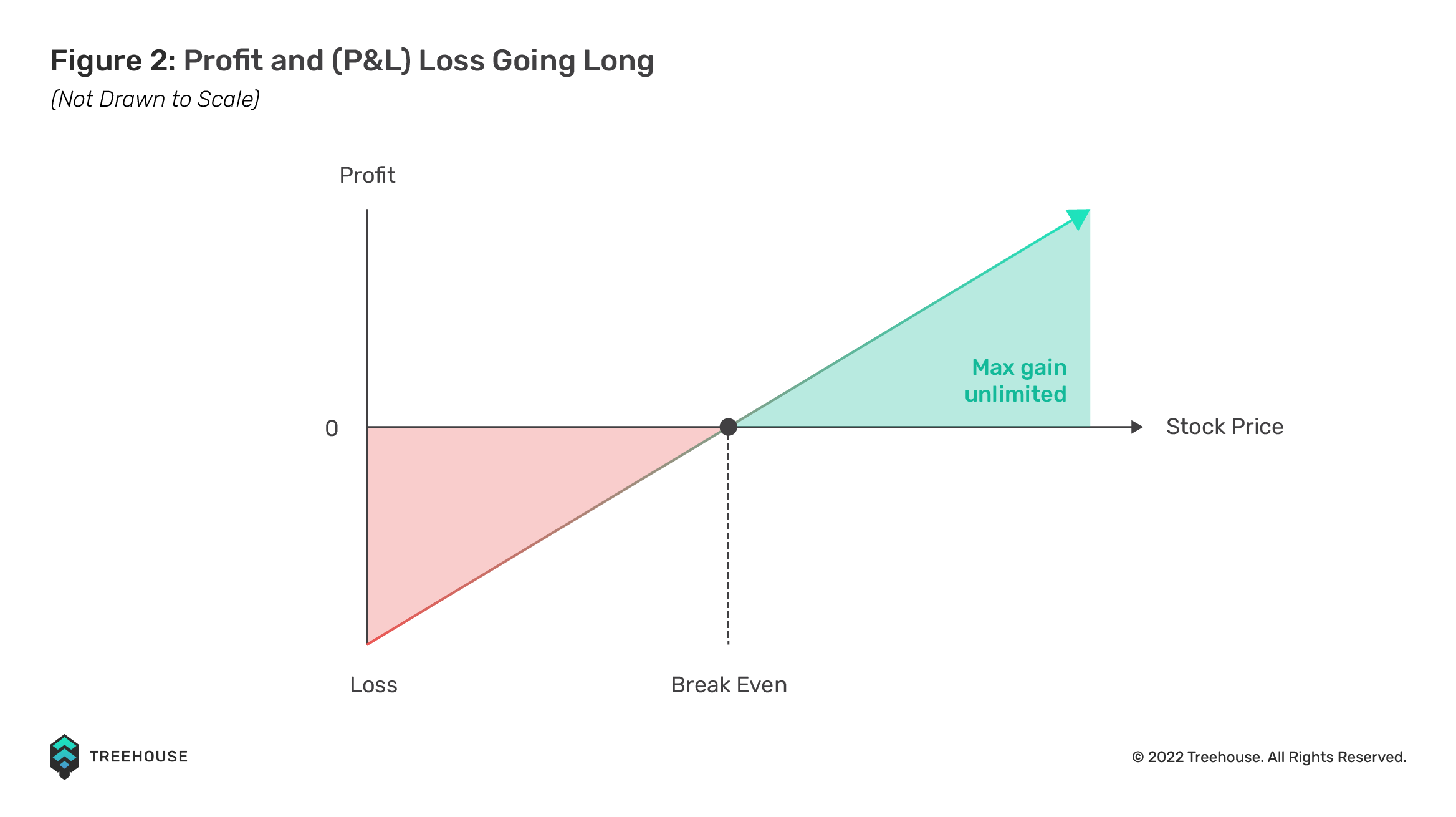

When longing an asset, investors purchase the asset at its current price with hopes that it will appreciate in the future. In this case, they are “bullish” on the asset, possibly due to a positive development in the project or a positive outlook on the general market. Going long is one of the most basic investing strategies, and it is less risky than going short, as evident from the “Risk of Ruin”, a concept applied throughout this article.

The Risk of Ruin refers to the probability that an individual will lose substantial amounts of money through investing or trading until it is no longer possible to continue. In other words, up to the point where their account goes down to $0. For a long position to arrive at ruin, the underlying asset we are going long on has to drop in price by 100%, meaning it goes to $0. The downside is technically limited in this case, as the lowest the asset can go to is $0.

2. Going Short

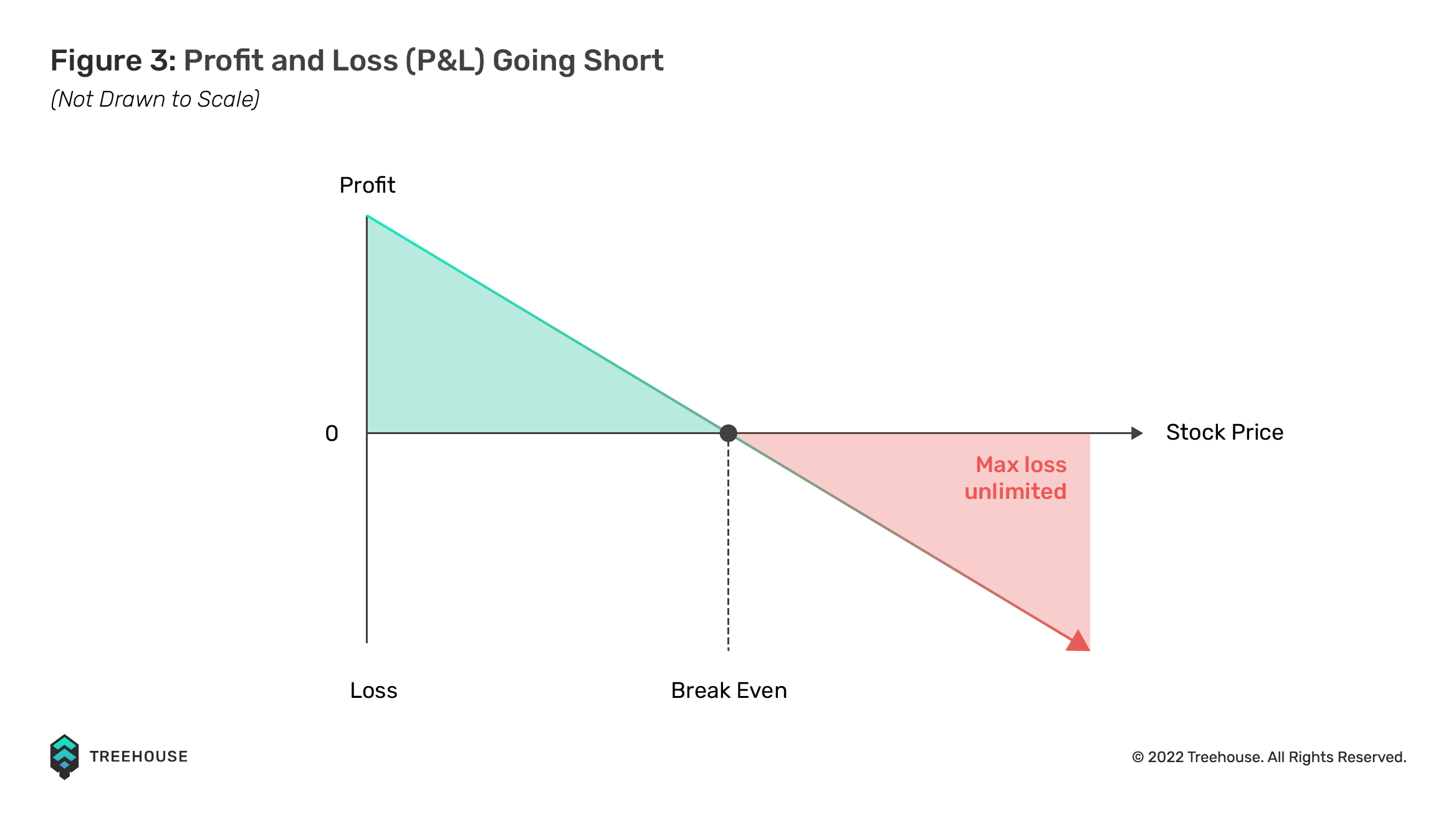

Investors short an asset when they are confident that its price will decrease within a given time frame. Shorting involves borrowing a certain amount of an asset from an exchange and selling it at market value. In the best case scenario, the asset’s price drops as predicted and investors buy the asset while returning the amount borrowed, plus any interest owed, back to the exchange. Profit from shorting an asset can be calculated by subtracting the exit price from the entry price.

Profit From Shorting = Entry Price – Exit Price

In most cases, it is harder to go short than long. Investors must get their trade thesis and timing right to make a successful short trade. An asset can appreciate 100% before going down 50%. Going short is thus riskier than going long, and you should be well versed in the markets before shorting an asset.

Using the concept of Risk of Ruin, for a short position to arrive at ruin, the asset has to increase in price by 100%, which is not unheard of in the crypto space. The downside is not limited as the upside for any asset is not capped at a particular value, and the possibility of losing more than you have invested is genuine. As seen in Figures 2 and 3, maximum gain is unlimited when longing, but maximum loss is unlimited when shorting. Hence, going short is riskier than going long.

3. Leverage Trading

Leverage trading presents the greatest risk out of these three basic strategies. In leverage trading, borrowed capital is used to trade an asset. To begin leveraged trading, a deposit known as “margin” is used to increase a user’s exposure to an underlying asset. This margin represents a fraction of the full value of the trade or investment. Based on the leverage ratio determined by the user, the provider, which could be a centralized exchange (CEX) or decentralized exchange (DEX), loans them the remainder.

By allowing users to engage in trades with borrowed funds that multiply their initial investment, leveraged trading offers augmented returns compared to entering a standard long or short position.

However, the opposite is also true—any losses that users experience while engaged in leverage will be multiplied. Users can lose their margin once the price reaches a certain threshold in an event known as liquidation, where they would have to supplement their account with more funds or the position is closed. For example, an increase in asset price of just 50% can lead to liquidation of a 2× levered short position. For instance during the LUNA and UST saga, there were cascading liquidations of short positions as the price of LUNA appreciated by 80% within a short time. One example would be Uprise Investment Fund losing US$20M while trying to short LUNA due to sudden price appreciation.

The table below shows an example of how leverage can affect P&L when an asset appreciates/depreciates by 20%.

| Unleveraged | Leveraged | |

|---|---|---|

| Margin | – | 10× |

| Deposit ($) | 1000 | 100 |

| Exposure ($) | 1000 | 1000 |

| Absolute P&L ($) | ± 200 | ± 200 |

| Percentage P&L (%) | ± 20 | ± 200 |

If not kept in check, leverage trading becomes synonymous with gambling as investors seek mouth-watering gains. Leverage trading is therefore extremely risky and should only be undertaken by experienced investors.

Conclusion

Price risk is one of the main risks investors take, and it is therefore imperative to know your potential upside and downside to mitigate losses. Measuring your price risk is crucial because it can indicate whether you should exit or enter a particular position at any given time.

At Treehouse, we want to empower people to confidently navigate DeFi, including helping users understand and assess risk properly. Check out our recommended list of risk-related pieces!

- How to Make Sense of Metrics in DeFi

- The Truth About Audits in DeFi

- DeFi Risks: What You Need to Know

- How to Manage Your DeFi Risks With This Framework

- Flash Loans and Flash Loan Attacks? What Are They and How to Prevent Them?

- A Look Back at Past Crypto Winters

- How to Measure Your Price Risk in DeFi

- Diversify Your Portfolio to Manage Your DeFi Price Risk

- How to Manage DeFi Price Risk by Setting Stop Losses

- How to Reduce DeFi Price With Delta Neutral Strategies

Disclaimer

This publication is provided for informational and entertainment purposes only. Nothing contained in this publication constitutes financial advice, trading advice, or any other advice, nor does it constitute an offer to buy or sell securities or any other assets or participate in any particular trading strategy. This publication does not take into account your personal investment objectives, financial situation, or needs. Treehouse does not warrant that the information provided in this publication is up-to-date or accurate.

Hyperion by Treehouse reimagines workflows for digital asset traders and investors looking for actionable market and portfolio data. Contact us if you are interested! Otherwise, check out Treehouse Academy, Insights, and Treehouse Daily for in-depth research.