This article aims to provide an overview of the Ethereum network and its diverse functions. If you are unfamiliar with DeFi, consider reading our introductory article on DeFi here first. You might also want to read our articles on blockchain and cryptocurrency before reading this article.

What Came Before Ethereum?

Bitcoin preceded Ethereum, and it revolutionized the financial space by becoming the first digital currency allowing individuals to send and transfer funds directly without an intermediary through blockchain technology. Transactions are stored in public ledgers of the blockchain and shared between nodes. Each transaction is validated and confirmed by miners through the Proof-of-Work (PoW).

However, Bitcoin’s network can be slow and expensive. In 2013, Russian-Canadian programmer Vitalik Buterin and several other crypto entrepreneurs founded Ethereum, a platform built to improve the Bitcoin system. The developers officially launched the network on 30 July 2015.

The Ethereum Network

Ethereum is the second largest chain by market capitalization, and it introduced smart contracts to the crypto space. It is a community-driven, open-source software platform with about 10,000 independent nodes, allowing users to develop and build decentralized applications (dApps) on the platform with its robust infrastructure. To run a dApp, users can simply deploy smart contracts on the Ethereum blockchain. Additionally, transaction and gas fees are paid in Ether (ETH), its native utility coin.

Some dApps have achieved millions of dollars in market capitalization, including Uniswap, Curve Finance, and OpenSea. However, if a dApp uses too many computational resources, the entire network may get overwhelmed with transactions. The number of unvalidated transactions can quickly balloon and result in an extended waiting time.

Network congestion is especially challenging for Ethereum as it tries to reconcile the Blockchain Trilemma. The theory poses that a blockchain can only simultaneously optimize two out of three aspects: decentralization, scalability, and security. Ethereum struggles with scalability, evident from its high transaction fees.

Ethereum’s Solutions

EIP-1559

EIP-1559 proposes a hybrid system with base fees and tips to keep the usage of the Ethereum network to 50%. Instead of gas fees from the current protocol, an algorithm will determine the mandatory base fee, which will fluctuate depending on network congestion. If the network usage exceeds 50%, the base fee automatically increases and vice versa.

This pricing system automatically prices transaction fees, removing any responsibility from users to set their gas limits. Moreover, base fees are burnt following its collection and not pocketed by the miners. This reduces the supply in circulation, so ETH’s value will increase over time due to rising scarcity.

Users can offer tips to the miners for urgent transactions, incentivizing them to prioritize these transactions. According to EIP-1559, approximately 50% of available block space is available for transactions that include tips.

Learn more about Ethereum token standards here!

Ethereum 2.0 (Eth2): Proof-of-Stake (PoS)

At the core of Eth2 is the Beacon Chain that went live on 1 December 2020. It is a PoS blockchain that stores and manages the registry of validators, addressing issues of accessibility, scalability, and centralization in Eth1. Validators stake ETH on the network to activate the validator software and are rewarded with newly minted ETH by the Beacon Chain once transactions are processed successfully.

Eth2: Sharding Chains

Sharding breaks up the blockchain into different storage layers for applications. These separate shards will become independent blockchains known as shard chains, and 64 shard chains will simultaneously process the workload at any given time, making the network faster and addressing scalability issues.

How Do the Solutions Address Ethereum 1.0’s Challenges?

Energy Efficiency

Under Ethereum 1.0 (Eth1), the network’s annual energy consumption was 26000GWH. Compared to the Tezos network, which operated under the PoS system, Tezos validators expended only 60MWH annually. Instead of relying on energy-intensive computer farms, users invest in the native token ETH to begin validating.

Faster Transaction Speeds

Without the complex computational services involved in mining, the PoS system has a quicker processing rate which reduces high congestion levels caused by the PoW system and allows for greater scalability. With EIP-1559, validators can confirm transactions in less than a minute, even with high network usage.

Greater Scalability

Sharding chains enable Layer-2 solutions for greater scalability by allowing parallel processing and reducing the network’s high latency. The network validators are assigned a manageable portion of the database, thus decreasing their workload.

The Future of Ethereum: The Merge

The Merge has replaced the original term, Eth2. Rather than two networks, Ethereum’s developers are looking to incorporate the Beacon Chain into the Mainnet, marking the end of the PoW consensus mechanism. As a single chain, the Mainnet is the “execution layer” which handles the transaction requests and executes them. The Beacon Chain will be called the “consensus layer”, which controls the PoS system.

The Merge is set to launch in August 2022 before the difficulty bomb is triggered. The “difficulty bomb” refers to an element coded into the Ethereum blockchain to slow down the network. By making it difficult to remain on the PoW chain, miners are encouraged to switch to the PoS system. The future of Ethereum continues to burn bright as major upgrades are in the pipeline even after The Merge. For an in-depth look at each phase, check out this podcast by Bankless, featuring Ethereum’s founder Vitalik Buterin.

Ethereum is supported by our DeFi analytics platform, Harvest! Protocols such as Lido, Uniswap, Curve, Aave, and many more are now available. Harvest users can view their digital assets across three chains: BNB Chain, Ethereum, and Avalanche. Try it here!

Disclaimer

This publication is provided for informational and entertainment purposes only. Nothing contained in this publication constitutes financial advice, trading advice, or any other advice, nor does it constitute an offer to buy or sell securities or any other assets or participate in any particular trading strategy. This publication does not take into account your personal investment objectives, financial situation, or needs. Treehouse does not warrant that the information provided in this publication is up-to-date or accurate.

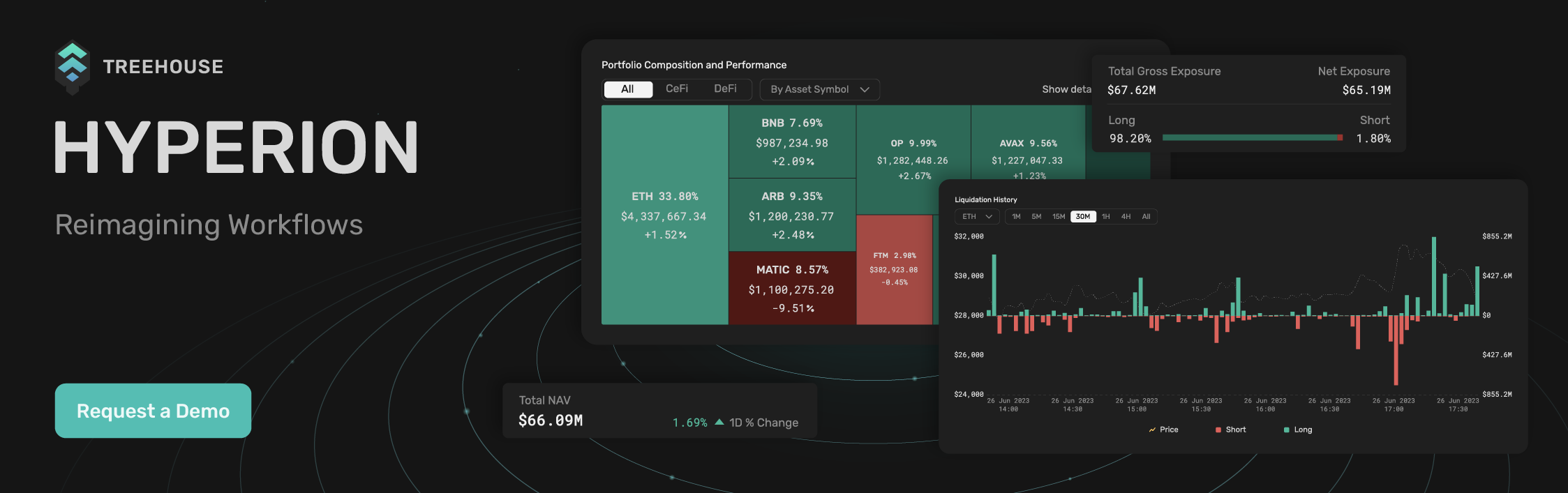

Hyperion by Treehouse reimagines workflows for digital asset traders and investors looking for actionable market and portfolio data. Contact us if you are interested! Otherwise, check out Treehouse Academy, Insights, and Treehouse Daily for in-depth research.