This article aims to provide insight into cryptocurrency staking. It references blockchains, Layer-1s, and liquid staking. If you are unfamiliar with the concept of DeFi, do read our introductory article to DeFi before reading this article.

What Is Staking?

Staking refers to locking up crypto assets into smart contracts in exchange for rewards. By committing assets to a particular network, users can become validators who are responsible for verifying transactions on the blockchain. In return, they receive rewards in the blockchain’s native currency. This process is part of the Proof-of-Stake consensus mechanism.

What Is Proof-of-Stake?

Proof-of-Stake (PoS) is a consensus mechanism used by blockchain networks to validate transactions and add new blocks to the chain. Validators are required to stake a minimum amount of crypto on the network and are randomly assigned by the system to validate transactions. If the transactions are accurately processed, they will be rewarded in the blockchain’s native token. The larger the amount of crypto staked, the higher the chances of a node being selected.

Why Proof-of-Stake?

Before PoS was invented and popularized, blockchain networks mainly utilized the Proof-of-Work (PoW) consensus mechanism.

Under PoW, miners use highly specialized computer equipment to solve complex mathematical puzzles and validate transactions. The fastest miners to complete the task are rewarded in the blockchain’s native token. Despite maintaining a high level of security and decentralization, PoW blockchains such as Bitcoin and Ethereum 1.0 are slow and difficult to scale. Furthermore, the huge amount of computational power required to operate its nodes makes it incredibly energy-intensive and harmful to the environment. These drawbacks make PoW highly unsustainable in the long run.

On the other hand, PoS requires a significantly lower amount of energy while increasing throughput and scalability. Without the need for highly specialized equipment, it also poses a lower barrier to entry. This is why many Layer-1 blockchains use PoS, despite having less robust security compared to PoW. For example, the Ethereum network has been gradually developing itself with the ultimate goal of transitioning into Ethereum 2.0, which uses PoS instead of PoW previously.

Ways To Stake

1. Become a Validator

To run a validator node, you are usually required to stake a substantial amount of crypto. For example, a minimum amount of 32 ETH is required to run a node on Ethereum, with a lock-up period of 365 days. This incentivizes good validator behavior as they could be penalized for going offline or inaccurately verifying transactions. If there is an attempt to attack the system, their entire lock-up amount could be lost. To start running a validator node, you can visit the official website of your desired network and sign up to become a full validator.

2. Join a Staking Pool

Users with smaller capital can participate in the network by joining staking pools. Rather than having to commit a considerable amount of crypto to become a validator, staking pools allow many users to merge their resources together and run a node. However, the rewards are significantly lower as they are split between many stakeholders. Furthermore, many of these pools charge a small amount of staking fees on your rewards.

3. Stake on Centralized Exchanges (CEX)

If you own crypto, there is a high chance that you use a CEX such as Binance, Kraken, FTX, or Coinbase. Many of these exchanges run validator nodes using deposited crypto assets as stake. To stake your crypto, simply deposit the assets and click on the staking option. This process is usually quick and easy. However, do take note of any lock-up or unstaking periods, as well as staking fees.

4. Liquid Staking

Liquid staking is a newly emerged concept that allows users to stake crypto without losing its liquidity. When users deposit their crypto on such protocols, they are issued with a derivative of the staked token that can be used for yield farming while the staked crypto is still earning its rewards. This form of staking is extremely attractive to many DeFi users as it allows them to enhance their returns by farming rewards on their rewards. Some of the well-known liquid staking protocols include Lido Finance, Marinade Finance, and Rocketpool.

Remember to keep a tab on your staked positions using a portfolio tracker such as Harvest by Treehouse! It provides a comprehensive analysis of all your DeFi positions!

Risks of Staking

1. Volatility

Crypto prices are highly volatile – they fluctuate a lot. Despite earning stable interest on your staked assets, a huge drop in its value may outweigh any reward earned via staking.

2. Lock-up Periods

Validators usually have a long lock-up period on their staked assets which pledge their commitment to the network. Staking pools may also require a minimum lock-up duration on staked assets. This illiquidity may be a huge disadvantage to users who want to access their crypto and adjust their positions in times of severe volatility.

3. Security Risks

Staking crypto on CEXs and DeFi protocols both come with security risks. With the advancement and increased adoption of blockchain technology, network exploits and crypto theft have never been more prevalent. In August 2021, over $611 million USD worth of tokens was stolen from the Poly Network in one of the largest crypto hacks in history. In another case, over $200 million USD worth of crypto assets was stolen from the Bitmart exchange, causing numerous users to lose their funds. To prevent this from happening, many exchanges and protocols run security audits or host bug bounty programs in order to find and rectify bugs or exploits. Before depositing your assets anywhere, make sure to do your own thorough research on the platform and ensure its reliability.

4. Validator Risks

Running a validator node comes with technical risks. Before becoming a validator, users should do thorough research on how the system works and ensure that they have the appropriate equipment to run a node. A validator node has to be constantly online while having the capacity to validate transactions accurately. Validation errors will incur penalties and can cause rewards to be significantly reduced. Electricity and hardware costs may also lower net rewards.

Conclusion

Staking is one of the most stable ways of earning interest on your crypto assets. Without becoming a validator, users can still participate by joining any of the staking pools out there though they usually charge small fees on your rewards. Despite posing certain risks, users can maximize the security of their assets by doing their own thorough research. With the new concept of liquid staking, we can see even better ways of staking with lower risks and higher rewards. As long as Proof-of-Stake (PoS) is here to stay, staking will remain one of the most stable ways of earning interest on your crypto.

Disclaimer

This publication is provided for informational and entertainment purposes only. Nothing contained in this publication constitutes financial advice, trading advice, or any other advice, nor does it constitute an offer to buy or sell securities or any other assets or participate in any particular trading strategy. This publication does not take into account your personal investment objectives, financial situation, or needs. Treehouse does not warrant that the information provided in this publication is up-to-date or accurate.

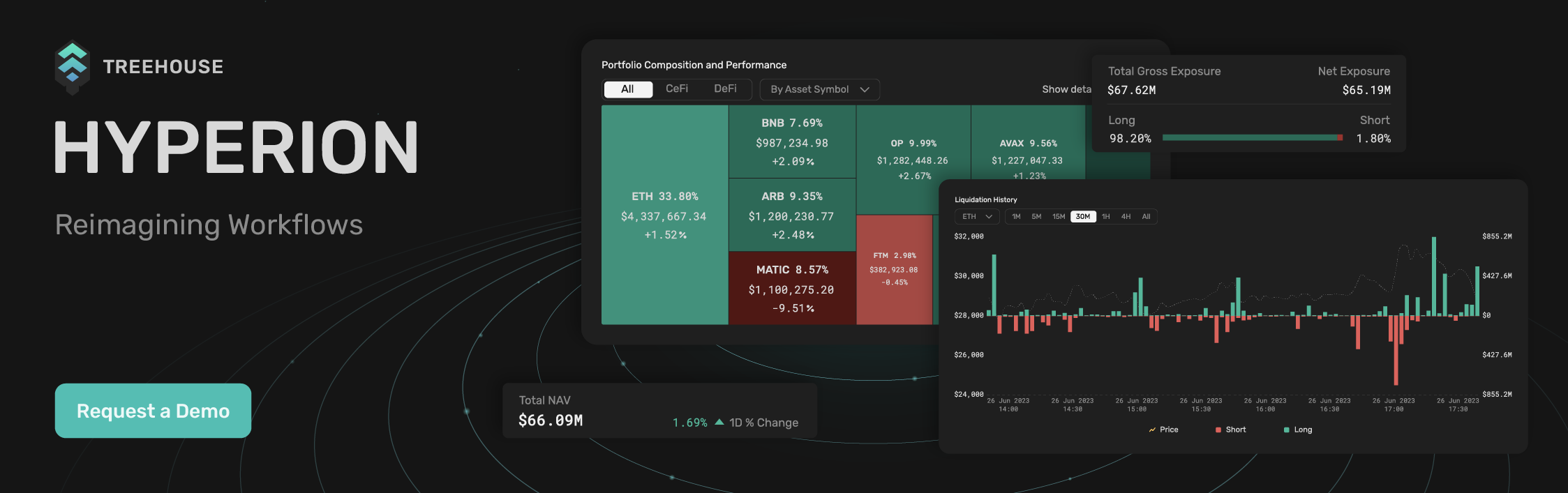

Hyperion by Treehouse reimagines workflows for digital asset traders and investors looking for actionable market and portfolio data. Contact us if you are interested! Otherwise, check out Treehouse Academy, Insights, and Treehouse Daily for in-depth research.